New laws on UK tipping have been (and will be) making their way through hospitality over 2024 and into 2026.

The new law on tips in the UK, which was introduced in October 2024...

- Makes it illegal to withhold any tips or service charges from staff

- Ensures employers distribute all tips fairly

- Requires businesses to put processes & systems in place to record & track tips

Further updates to UK tipping from the Employment Rights Bill (expected in October 2026) will require employers to...

- Consult staff before creating their tipping policy

- Update the tipping policy every 3 years

What are the reasons behind these changes to UK tipping?

Following reports back in 2015 of some major restaurant chains deducting from tips before passing them to staff, people rightly called for fairer treatment of hospitality workers - especially in receiving their full tips and service charges as intended. However, COVID-19 added salt to the wound it had already given the hospitality industry. With the introduction of cashless transactions, staff found it more difficult to track their tips. This only made the calls for action louder.

The Government previously brought us "The UK Tipping Act 2023". This new law on tips and the statutory Code of Practice came into effect on 1st October 2024, with extra measures planned for October 2026.

Below are the key things you need to know and what you need to do to prepare.

Requirements for the new law on tips in the UK

100% of qualifying tips must be given to staff

Under the new legislation, it's unlawful for a business to hold back any tip, gratuity, or service charge and not pass it to their employees.

100% of qualifying tips must be given to staff. This includes discretionary charges, whether card or cash, and you cannot make any deductions from the tip, such as card charges or admin costs (with the only exception being tax).

Tips must be distributed fairly to all workers, including agency staff who must be treated the same as employed staff. Consider all those involved in providing that customer service!

Operators will need to have a written policy available to all staff that details how tips are distributed

Each business must have a written policy, available to all staff, that clearly states how tips are collected and distributed.

From October 2026, employers will be expected to consult the tipping policy with staff before it is made and update it every 3 years.

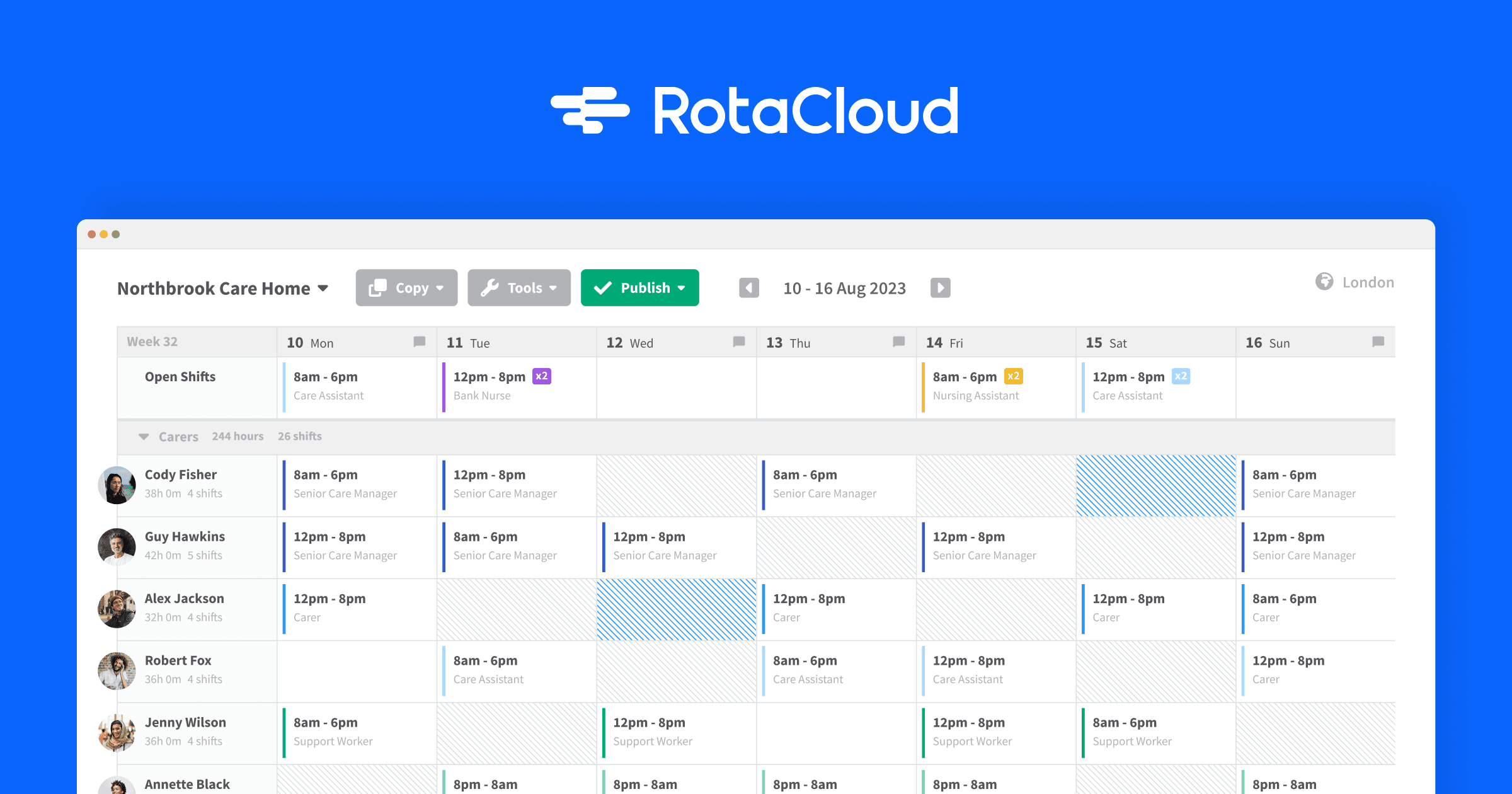

This policy could be included in your staff handbook or be a standalone document. You could also require this new policy to be acknowledged so that you have evidence of all staff being aware. (You can do this using RotaCloud's Document Acknowledgement feature!)

When writing a policy, make sure it's clear and easily understandable. It doesn’t have to be long or complicated; the most important thing is that it details exactly how you plan to collect, manage, and distribute tips at your business.

How to write a tips policy for hospitality businesses

If you don't already have a written policy for tips and their distribution to staff, here are some things that you may want to consider:

- How you’ll collect tips, using ‘X’ method (card, cash, both)

- The name of the person responsible for managing tips

- How tips will be divided

- How tips will be distributed

- When tips will be distributed*

- What happens during leave (e.g. holidays, sick leave, parental leave)

Businesses should also record all tips taken and how they are distributed.

You will need to keep a written (or electronic) record of all tips taken, and include the total amount, when they were taken, who they were given to, and how they were ultimately distributed.

Workers will have the right to request to see all of this information, so it must be accessible to staff. It also needs to be kept accurate and up to date, as it can be used as evidence in an employment tribunal in the case of a dispute. Records must be kept for 3 years, beginning with the date on which the qualifying tip, gratuity or service charge was paid.

You can use services like TipJar to track tips or keep a spreadsheet stored using your RotaCloud account's Document Storage feature.

Wrap-up

The UK's new tipping bill will lead the hospitality industry to make some changes. Whether employers already have a process in place for allocating tips or will be starting from scratch, they must ensure that:

- They have a written policy, whether physical or electronic

- The process they have follows the law

- They consult staff before creating (or amending) the policy (for October 2026)

There may be extra financial costs associated with collecting and processing tips. From costs like card fees to the increased admin time you may need, you’ll have to have a plan in place for this ahead of the new laws coming into effect in October.

The new legislation can be read in full here.

Save yourself the admin headaches

With all the tools you need at your fingertips, you can save an average of 170 hours of admin a year!

Editor's Note: This post was originally published in June 2023 and updated for accuracy in August 2024 and October 2025.