After years of drafts, speculation and proposals, the Government has officially outlined the changes to UK employment law that will replace EU-derived laws at the start of 2024.

The most notable of the changes are to do with laws surrounding holidays, in particular rolled-up holiday, holiday carry-over, and rules for irregular hours workers.

With that in mind, here’s a plain-English guide to what’s changing, what you as an employer need to know about it, and how RotaCloud can help.

Rules for holiday accrual

Rules for rolled-up holiday pay

Rules for holiday carry-over

How these changes affect employers

Rules for holiday accrual

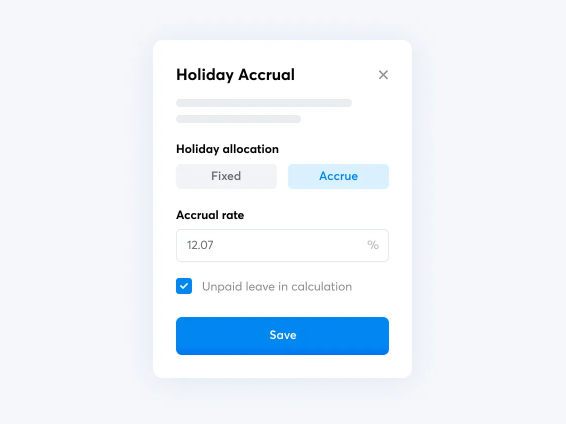

Despite initially proposing a brand new system for how employees will accrue holidays, the government has ultimately decided on a much simpler system. Effective from 1st April 2024*, both irregular hours and part-year workers will accrue holiday at a rate of 12.07% of the total number of hours they work in each pay period, up to a maximum of 28 days of annual leave per year.

For example, if an employee works 160 hours in a pay period one month long, they'll automatically be entitled to 19 hours of annual leave. This amount should then be added to the employee’s overall leave allowance, and made available for them to take from the start of the next pay period.

Automatic Holiday Accrual with RotaCloud

Put down the calculator — RotaCloud automatically calculates how much annual leave your employees are entitled to with each shift they work.

*Note that this rule will only apply for employees whose holiday years start on or after 1st April 2024. If your business’ leave year is a calendar year, for example, the above rules won’t apply until 1st January 2025.

Rules for rolled-up holiday pay

We’ve talked about rolled-up holiday pay before on the RotaCloud blog — specifically in regard to whether it’s legal for employers to bundle employees’ holiday pay in with their basic hourly wages instead of giving them paid time off.

As a member of the European Union, UK employers were technically not allowed to do this, with the main concern being that employees needed that time to properly rest and recuperate.

As of 1st of April 2024, however, UK employers will once again be allowed to offer rolled-up holiday pay to their staff in some circumstances:

- If an employee is classed as either an irregular hours worker (i.e. their regularly shifts change) or a part-year worker.

- Their holiday pay is set at 12.07% of their standard hourly rate rather than based on their previous year’s hours.

- Holiday pay must be added at the end of the pay period in which the work was done.

- An employee’s rolled-up holiday pay must be clearly shown, separately, on their payslip and not simply added to their pay without mention of where it came from.

Bear in mind that, while employees have the right to request rolled-up holiday pay, they can’t be forced to take it. The option must also be clearly defined in employees’ employment contracts or employee handbook.

It’s also important to note that, even if they’re given rolled-up holiday pay, employees are not permitted to work all 52 weeks in a year — under the Working Time Directive, an employee must not work more than 48 hours per week on average across a 12-month period.

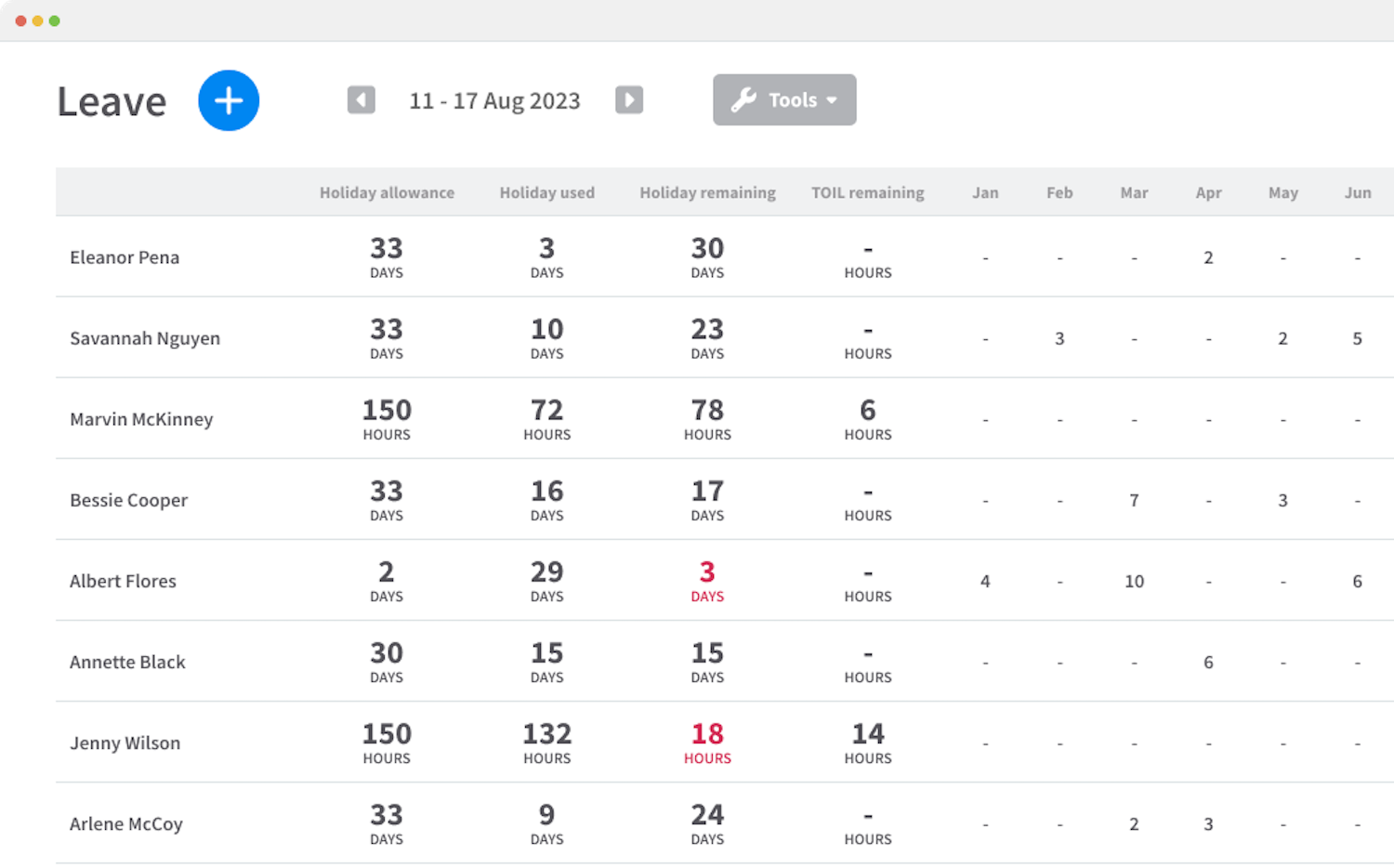

Annual leave management made easy

RotaCloud brings all of your team's holidays, TOIL, sickness, and accrued leave together in one place.

Rules for holiday carry-over

From 1st April 2024, employees (including part-time and irregular-hours workers) will be allowed to carry over any unused annual leave, but only under the following circumstances:

- The employee wasn’t given reasonable opportunity to use their remaining annual leave.

- The employee was unable to take all of their leave due to sickness, or being on maternity, paternity, adoption, or parental leave.

- The employee wasn’t encouraged to use up their remaining annual leave before the leave year ended.

- The employee wasn’t made aware that they had holiday remaining, and that they would lose it if it wasn’t taken by the end of the leave year..

These rules are based on existing EU employment laws, so nothing much should change for UK employers, but it’s important to be aware of what’s required of employers.

How these changes affect employers

Sian Whelan, Managing Director at Norton Loxley advises that "it goes without saying that UK employers should familiarise themselves with the upcoming changes to employment law in order to remain fully compliant and protect both their employees and their business.

"Following a confusing period for employers on how best to calculate annual leave for irregular workers as a result of the Harper Trust V Brazel decision," Sian continues, "these changes are likely to be welcomed by many as they aim to simplify how employers should calculate holiday pay for irregular workers moving forwards."

"In practice, the biggest impact that these changes will have on employers will be administrative — for instance, keeping track of the exact number of hours employees have worked each day (not just the number of hours they were scheduled to work), updating their accrued holiday, and updating employees’ holiday individual allowances each year."

"One way to help streamline this administrative process it to make use of an HR or staff scheduling system to reduce the administrative burden on employers when calculating annual leave."

How RotaCloud can help

With RotaCloud’s Holiday Accrual feature, employees’ leave allowances are automatically updated at the end of each pay period, based on the number of hours they’ve worked. Employees can see the exact amount of leave they have remaining via the RotaCloud mobile app, encouraging them to make use of their holidays and providing a quick and easy way of requesting time off.

You can try RotaCloud free for 30 days, with no credit card required, here.